- 185.50 KB

- 2022-09-01 发布

- 1、本文档由用户上传,淘文库整理发布,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,请立即联系网站客服。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细阅读内容确认后进行付费下载。

- 网站客服QQ:403074932

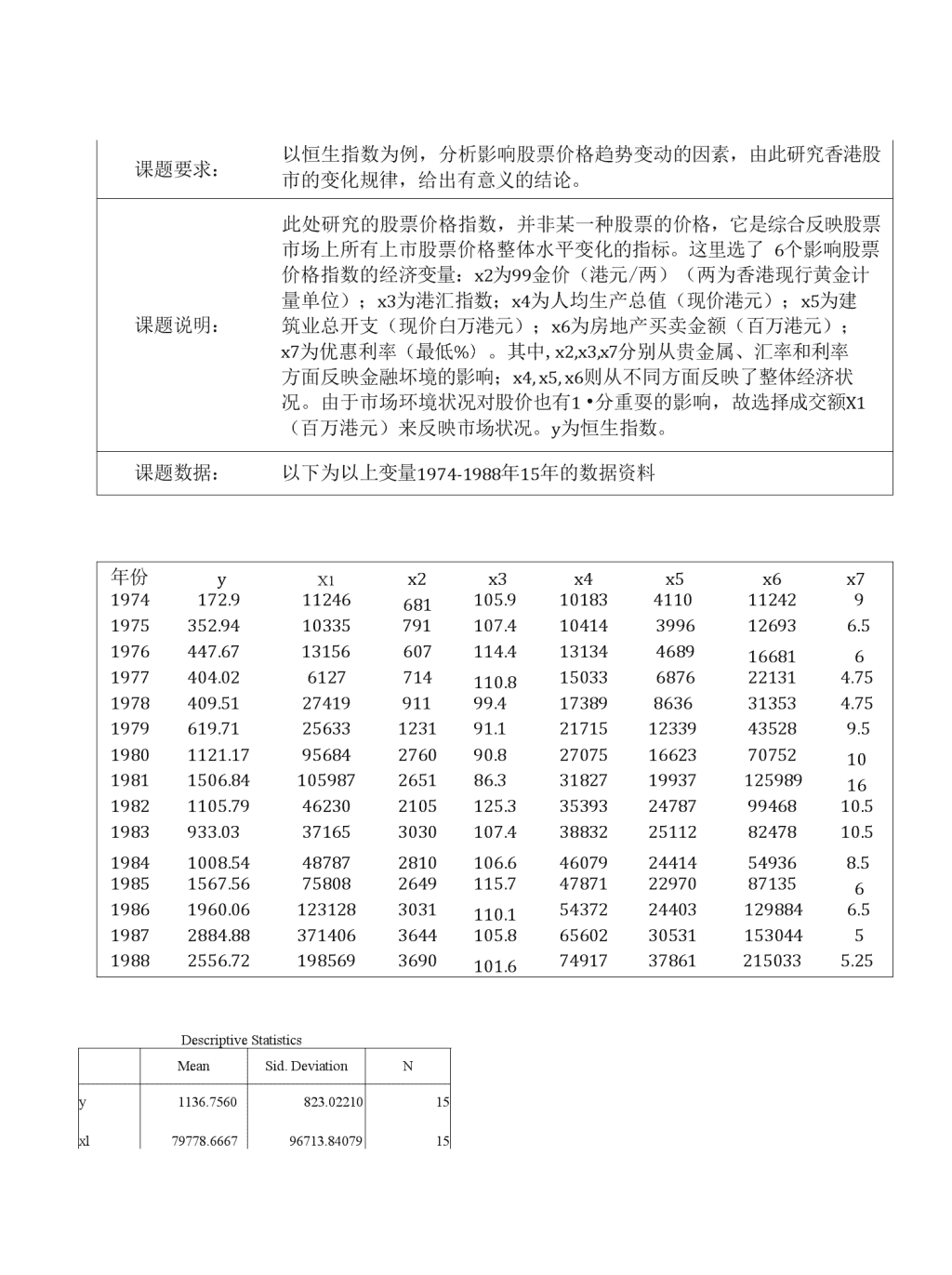

课题要求:以恒生指数为例,分析影响股票价格趋势变动的因素,由此研究香港股市的变化规律,给出有意义的结论。课题说明:此处研究的股票价格指数,并非某一种股票的价格,它是综合反映股票市场上所有上市股票价格整体水平变化的指标。这里选了6个影响股票价格指数的经济变量:x2为99金价(港元/两)(两为香港现行黄金计量单位);x3为港汇指数;x4为人均生产总值(现价港元);x5为建筑业总开支(现价白万港元);x6为房地产买卖金额(百万港元);x7为优惠利率(最低%)。其中,x2,x3,x7分别从贵金属、汇率和利率方面反映金融坏境的影响;x4,x5,x6则从不同方面反映了整体经济状况。由于市场环境状况对股价也有1•分重耍的影响,故选择成交额X1(百万港元)来反映市场状况。y为恒生指数。课题数据:以下为以上变量1974-1988年15年的数据资料年份yX1x2x3x4x5x6x71974172.911246681105.91018341101124291975352.9410335791107.4104143996126936.51976447.6713156607114.41313446891668161977404.026127714110.8150336876221314.751978409.512741991199.4173898636313534.751979619.7125633123191.12171512339435289.519801121.1795684276090.82707516623707521019811506.84105987265186.331827199371259891619821105.79462302105125.335393247879946810.51983933.03371653030107.438832251128247810.519841008.54487872810106.64607924414549368.519851567.56758082649115.7478712297087135619861960.061231283031110.154372244031298846.519872884.883714063644105.86560230531153044519882556.721985693690101.674917378612150335.25DescriptiveStatisticsMeanSid.DeviationNy1136.7560823.0221015xl79778.666796713.8407915\nx22087.00001141.1728915x3105.240010.2703315x433989.066720441.0467115x517818.933310589.1651215x677089.800059466.8155415x77.91673.0947315Correlationsyxlx2x3x4x5x6x7Pearsony1.000.917.884-.041.938.879.937-.096Correlation斗].9171.000.737-.128.784.697.782-.173x2.884.7371.000-.106.919.948.875.152x3-.041・・128-.1061.000.074.048-.094-.416x4.938.784.919.0741.000.960.914-.141x5.879.697.948.048.9601.000.917.067x6.937.782.875・.O94.914.9171.000.062x7・.O96・.173.152・.416.067.0621.000Sig.(1-tailed)y■.000.000.442.000.000.000.367xl.000•.001.325.000.002.000.268x2.000.001■.353.000.000.000.295x3.442.325.353•.397.433.370.061x4.000.000.000.397•.000.000.308x5.000.002.000.433.000•.000.407x6.000.000.000.370.000.000•.414x7.367.268.295.061.308.407.414■Ny1515151515151515xl1515151515151515x21515151515151515x31515151515151515\nx41515151515151515x51515151515151515x61515151515151515x71515151515151515表correlations显示这项研究中所有变量的二元相关性。P的均值为0.139,大于0.05,故所有变量Z间的相关性不显著,其中y和x7Z间的相关性最高,y和x3Z间的相关性最低。y与xl、x2、x4、x5、x6成正相关,y与x3、x7成负相关。ModelSummarybMode1RRSquareAdjustedRSquareStd・ErroroftheEstimateDurbin-Watson1.995」.990.981114.16971.543a.Predictors:(Constant),x7,x6,x3,xl,x2,x5,x4b・DependentVariable:y白变量解释了y的方差的99%,冋归方程预测y时平均偏离人约114.17。AN0VAbMode1SumofSquaresdfMeanSquareFSig.1Regression9391872.22171341696.032102.933.(WResidual91243.014713034.716Total9483115.23514a.Predictors:(Constant),x7,x6,x3,xl,x2,x5,x4b.DependentVariable:y因为P一值小于0.05,所以冋归模型是显著的。自变量整体解释了y占显著比例的方差。Coefficients'Mode1UnstandardizedCoefficientsStandardizedCoefficientstSig.Col1inearityStatisticsBStd.ErrorBetaToleranceVIF1(Constant)-715.549470.020-1.522.172\nX1.003.001.3524.648.002.2404.165x2.156.117.2161.332.225.05219.078x36.0803.926.0761.549.165.5731.746x4.025.010.6162.386.048.02148.481x5・.O45.018-.573-2.429.046.02540.442x6.006.002.4393.517.010.08811.332x716.50819.398.062.851.423.2583.871a.DependentVariable:y由表coefficients知,x4对y的预测作用最大,然后依次是x5、x6>xl、x2^x3、x7。因为xl、x4、x5、x6的厂值都小于0.05,所以他们都是显著的,他们都解释了y占显著比例的方差。从异常波动因素可知x4、x5与其他预测变项共线问题较严重。可得预测y的回归方程:Y(y)=-715.594+0.003X1+0.156X2+6.08X3+0.025X4-0.045X5+0.006X6+16.508X7