- 153.00 KB

- 2022-09-01 发布

- 1、本文档由用户上传,淘文库整理发布,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,请立即联系网站客服。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细阅读内容确认后进行付费下载。

- 网站客服QQ:403074932

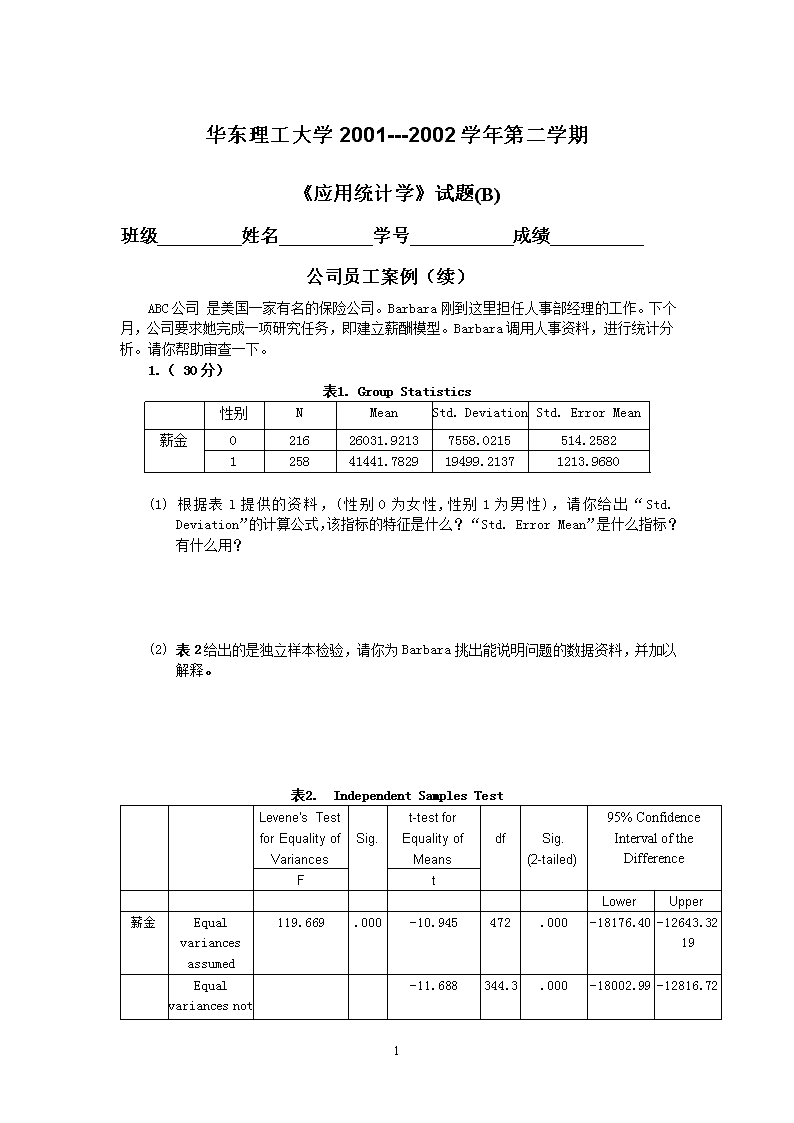

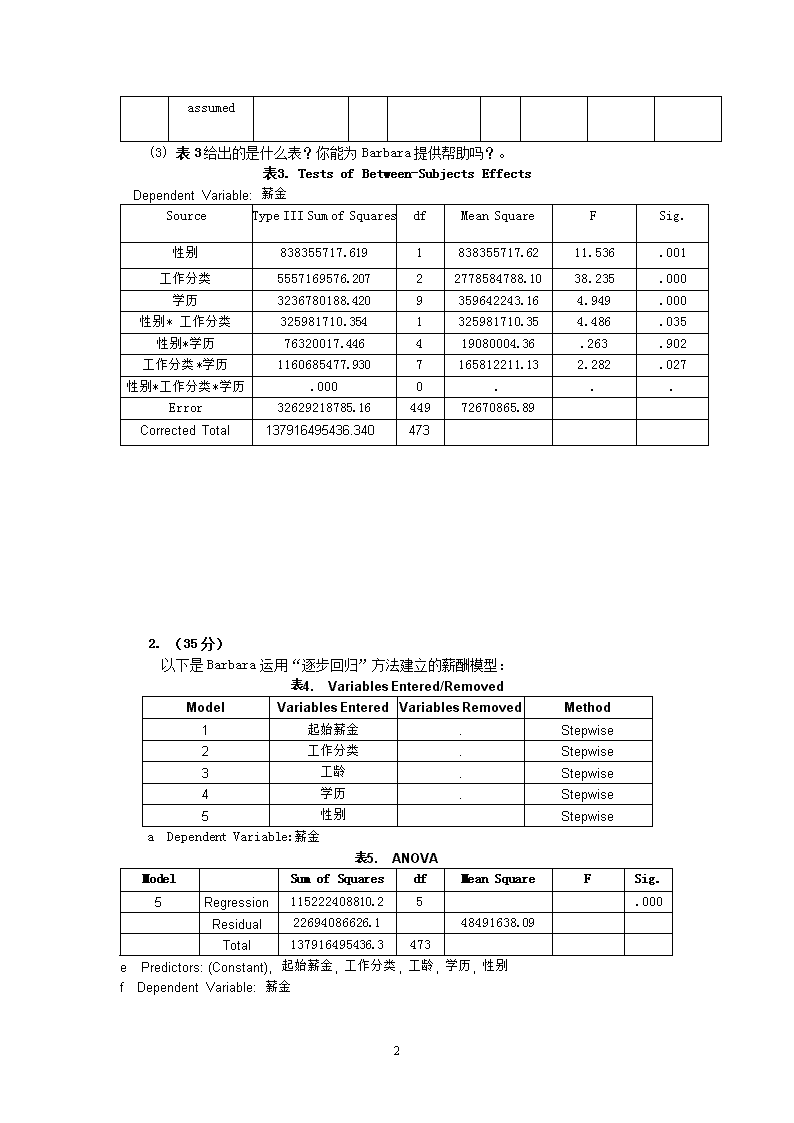

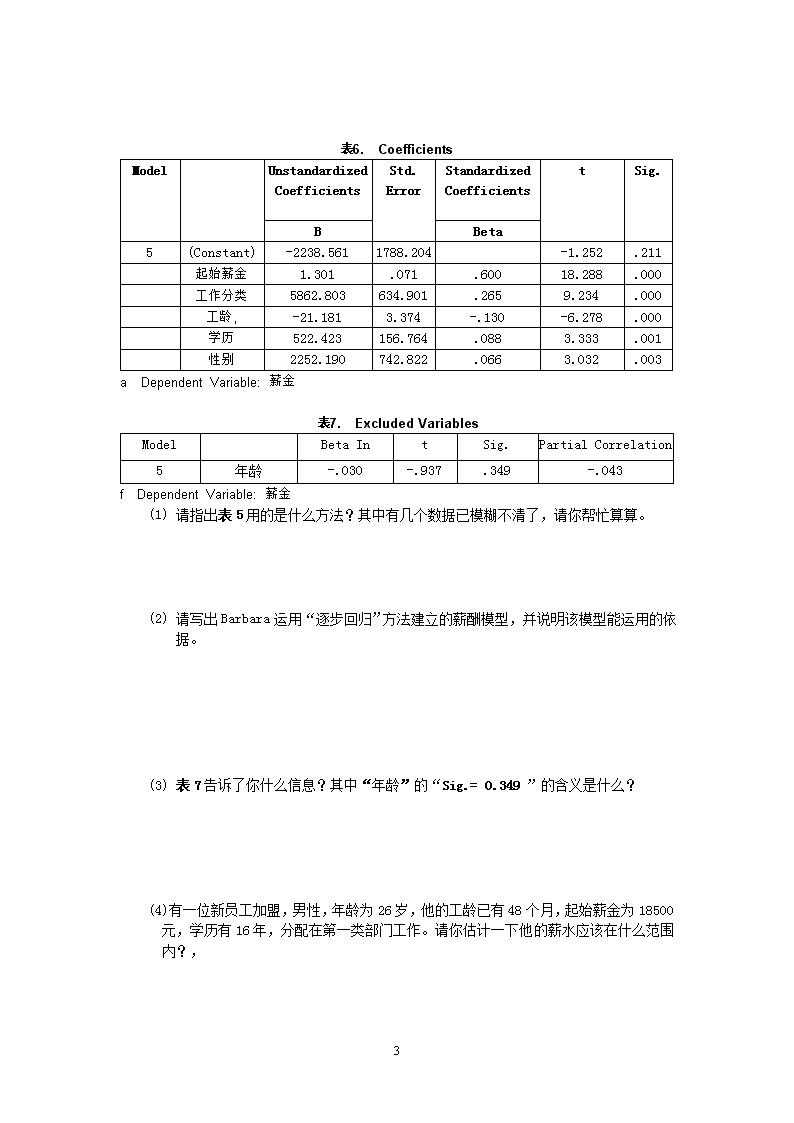

华东理工大学2001---2002学年第二学期《应用统计学》试题(B)班级_________姓名__________学号___________成绩__________公司员工案例(续)ABC公司是美国一家有名的保险公司。Barbara刚到这里担任人事部经理的工作。下个月,公司要求她完成一项研究任务,即建立薪酬模型。Barbara调用人事资料,进行统计分析。请你帮助审查一下。1.(30分)表1.GroupStatistics性别NMeanStd.DeviationStd.ErrorMean薪金021626031.92137558.0215514.2582125841441.782919499.21371213.9680(1)根据表l提供的资料,(性别0为女性,性别1为男性),请你给出“Std.Deviation”的计算公式,该指标的特征是什么?“Std.ErrorMean”是什么指标?有什么用?(2)表2给出的是独立样本检验,请你为Barbara挑出能说明问题的数据资料,并加以解释。表2.IndependentSamplesTestLevene'sTestforEqualityofVariancesSig.t-testforEqualityofMeansdfSig.(2-tailed)95%ConfidenceIntervaloftheDifferenceFtLowerUpper薪金Equalvariancesassumed119.669.000-10.945472.000-18176.40-12643.3219Equalvariancesnot-11.688344.3.000-18002.99-12816.728\nassumed(3)表3给出的是什么表?你能为Barbara提供帮助吗?。表3.TestsofBetween-SubjectsEffectsDependentVariable:薪金SourceTypeIIISumofSquaresdfMeanSquareFSig.性别838355717.6191838355717.6211.536.001工作分类5557169576.20722778584788.1038.235.000学历3236780188.4209359642243.164.949.000性别*工作分类325981710.3541325981710.354.486.035性别*学历76320017.446419080004.36.263.902工作分类*学历1160685477.9307165812211.132.282.027性别*工作分类*学历.0000...Error32629218785.1644972670865.89CorrectedTotal137916495436.3404732.(35分)以下是Barbara运用“逐步回归”方法建立的薪酬模型:表4.VariablesEntered/RemovedModelVariablesEnteredVariablesRemovedMethod1起始薪金.Stepwise2工作分类.Stepwise3工龄.Stepwise4学历.Stepwise5性别StepwiseaDependentVariable:薪金表5.ANOVAModelSumofSquaresdfMeanSquareFSig.5Regression115222408810.2523044481762.04475.226.000Residual22694086626.146848491638.09Total137916495436.3473ePredictors:(Constant),起始薪金,工作分类,工龄,学历,性别fDependentVariable:薪金8\n表6.CoefficientsModelUnstandardizedCoefficientsStd.ErrorStandardizedCoefficientstSig.BBeta5(Constant)-2238.5611788.204-1.252.211起始薪金1.301.071.60018.288.000工作分类5862.803634.901.2659.234.000工龄,-21.1813.374-.130-6.278.000学历522.423156.764.0883.333.001性别2252.190742.822.0663.032.003aDependentVariable:薪金表7.ExcludedVariablesModelBetaIntSig.PartialCorrelation5年龄-.030-.937.349-.043fDependentVariable:薪金(1)请指出表5用的是什么方法?其中有几个数据已模糊不清了,请你帮忙算算。(2)请写出Barbara运用“逐步回归”方法建立的薪酬模型,并说明该模型能运用的依据。(3)表7告诉了你什么信息?其中“年龄”的“Sig.=0.349”的含义是什么?(4)有一位新员工加盟,男性,年龄为26岁,他的工龄已有48个月,起始薪金为18500元,学历有16年,分配在第一类部门工作。请你估计一下他的薪水应该在什么范围内?,8\n案例:Croq’Pain公司(续)Croq’Pain是法国一家有名的快餐连锁店。MichelBoutillon在这里担任运作部经理的工作,其主要任务是在新连锁店建成以前完成开张的所有准备工作。上个月,公司要求他完成一项研究任务,即建立一套选择新店址的分析系统,并希望这套系统最好以统计分析模型为基础。Michel运用“逐步回归”方法建立了新店址选择的分析系统。公司总裁,JeanGerard,认为该系统对原有信息的利用率太低,丢失了一些有价值的信息。Gerard要求Michel重新审查该系统。Michel苦苦思考了两周,提出了新的思路。在提交给Gerard以前,请你帮助审查一下。3.(35分)以下所提供的资料是Michel苦苦思考了两周后提出的新思路。表8.TotalVarianceExplainedComponentInitialEigenvaluesTotal%ofVarianceCumulative%RotationSumsofSquaredLoadingsTotal%ofVarianceCumulative%14.81432.09532.0954.79931.99531.99522.39715.97748.0722.09713.98045.97631.4429.61557.6871.53710.24756.22341.2848.55766.2441.50310.02166.2445.9396.26272.5066.8705.80178.3077.8315.54083.8478.7835.21789.0649.7024.68193.74410.5133.42097.16511.3602.40299.567122.992E-02.19999.767131.930E-02.12999.895141.124E-027.492E-0299.970154.476E-032.984E-02100.000ExtractionMethod:PrincipalComponentAnalysis.8\n表9.RotatedComponentMatrixComponent1234投资-3.772E-02.901-.292.169店堂面积-5.625E-02.8763.416E-02-1.469E-02雇员人数-.1313.215E-02.281.580P15.972-1.618E-036.769E-02-3.020E-02P25.544-.1221.330E-02.109P35.9731.328E-025.018E-02-5.842E-02P45.9519.993E-025.846E-02-3.586E-02P55.762.103-.1761.049E-02TOTAL.9941.522E-02-8.370E-04-1.922E-03平均收入.132.477.458.111餐馆数-.157-.372.4779.689E-02非竞争餐Í7.960E-025.629E-02.7026.798E-02非餐企业6.356E-02-3.796E-025.418E-02-.662月租金4.235E-02.330-.624.360生活指数.2524.793E-02-9.201E-02.725ExtractionMethod:PrincipalComponentAnalysis.RotationMethod:VarimaxwithKaiserNormalization.表10.VariablesEnteredModelVariablesEnteredVariablesRemovedMethod1REGRfactorscore1foranalysis1.Stepwise2REGRfactorscore3foranalysis1.Stepwise3REGRfactorscore4foranalysis1.StepwiseaDependentVariable:毛利率表11.ModelSummaryModelRRSquareAdjustedRSquareStd.ErroroftheEstimate1.597.356.3458.9646E-022.753.568.5527.4103E-023.826.682.6656.4077E-02aPredictors:(Constant),REGRfactorscore1foranalysis1bPredictors:(Constant),REGRfactorscore1foranalysis1,REGRfactorscore3foranalysis1cPredictors:(Constant),REGRfactorscore1foranalysis1,REGRfactorscore3foranalysis1,REGRfactorscore4foranalysis1dDependentVariable:毛利率8\n表12.ANOVAModelSumofSquaresdfMeanSquareFSig.1Regression.2581.25832.054.000Residual.466588.036E-03Total.724592Regression.4112.20537.397.000Residual.313575.491E-03Total.724593Regression.4943.16540.088.000Residual.230564.106E-03Total.72459aPredictors:(Constant),REGRfactorscore1foranalysis1bPredictors:(Constant),REGRfactorscore1foranalysis1,REGRfactorscore3foranalysis1cPredictors:(Constant),REGRfactorscore1foranalysis1,REGRfactorscore3foranalysis1,REGRfactorscore4foranalysis1dDependentVariable:毛利率表13.CoefficientsModelUnstandardizedCoefficientsBStd.ErrorStandardizedCoefficientsBetatSig.1(Constant).178.01215.380.000REGRfactorscore1foranalysis16.608E-02.012.5975.662.0002(Constant).178.01018.606.000REGRfactorscore1foranalysis16.608E-02.010.5976.849.000REGRfactorscore3foranalysis15.094E-02.010.4605.280.0003(Constant).178.00821.517.000REGRfactorscore1foranalysis16.608E-02.008.5977.921.000REGRfactorscore3foranalysis15.094E-02.008.4606.107.000REGRfactorscore4foranalysis1-3.752E-02.008-.339-4.498.000aDependentVariable:毛利率8\n表14.ExcludedVariablesModelBetaIntSig.PartialCorrelation1REGRfactorscore2foranalysis1.068.645.521.085REGRfactorscore3foranalysis1.4605.280.000.573REGRfactorscore4foranalysis1-.339-3.516.001-.4222REGRfactorscore2foranalysis1.068.782.437.104REGRfactorscore4foranalysis1-.339-4.498.000-.5153REGRfactorscore2foranalysis1.068.906.369.121aPredictorsintheModel:(Constant),REGRfacorscore1foranalysis1bPredictorsintheModel:(Constant),REGRfactorscore1foranalysis1,REGRfactorscore3foranalysis1cPredictorsintheModel:(Constant),REGRfactorscore1foranalysis1,REGRfactorscore3foranalysis1,REGRfactorscore4foranalysis1dDependentVariable:毛利率表15.ResidualsStatisticsMinimumMaximumMeanStd.DeviationNPredictedValue-5.78791E-02.33533.177999.1484E-0260Residual-.14566.11362-2.03541E-176.2426E-0260Std.PredictedValue-2.5781.720.0001.00060Std.Residual-2.2731.773.000.97460aDependentVariable:毛利率(1)请指出Michel提出的新思路是采用的什么方法?8\n(2)请写出前四个特征根,并算出它们的贡献率和累计贡献率。试分别给所对应的四个综合指标命名。(3)请写出Michel按新思路建立的选址模型,并说明该模型能运用的依据。(4)请利用Michel提出的新思路再预测一下,“Calais”、“Toulouse”的毛利率;判断一下由选址专家提供的2处备选地点是否可行。表6.选址专家提供的2处备选方案餐馆投资店堂面积P15P25P35P45P55Total平均收入餐馆数非竞争餐非餐企业月租金生活指数Calais6605460025704306901440671038451822131Toulouse8362453400300025701200135011350375862131368